I was meeting with couple of sharp clients (as all our clients are!) in late June when the market was under distress due to Greek economic woes. They both laughed and one of them said “Greece? It’s like what, the size of Kansas?! It’s not Greece we have to worry about, it’s China!” The market did predictably shake of the Greece concern, with another V-Shaped recovery. The likes we’ve seen for nearly a few years now.

But the markets are now reacting to China (as predicted by the bright gentlemen above) – a real concern.

The reality is the market is psychology driven and it is going to do what is going to do regardless of the news. In a strong market, poor news is shaken off and investors continue to operate in a fashion that drives the market upward. In a lousy market, no amount of good news seems to be able to turn the market around.

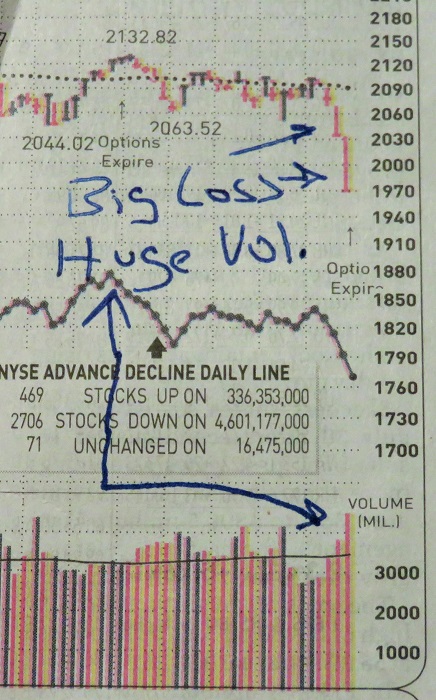

Thursday and Friday were awful days with big drops on huge volume (a topic discussed previously). Combine these days with the big volume declines seen on 08/06 and 07/24 and it appear institutional investors' [e.g. fund (mutual, pension, hedge) managers, investment banks etc.] opinion of the market has changed for the worse.

If you have aggressive positions in individual stocks, it's time to decide how you want to handle them. If you are down 8% or more in any position it’s time to cut bait. You should never allow a position to drop more than 7 or 8% form your purchase price. Consider it an Insurance policy (you pay a small premium to avoid a potentially huge loss). There will be times that the stock will turn around and you’ll wish you hadn’t sold. However, more often than not it will not recover and you will have protected not only your money, but you ego as well. A big loss can create significant self-doubt and be difficult to recover from (both financially and psychologically). Also, if it does recover in a healthy fashion (good price moves, in big volume) you can always get back in again.

Keep in mind when you read this, it comes from a man of Insurance, not a financial adviser, so use it how you see fit.

I say aloud, all proud: "Two posts in one weekend - one about flood and one about the market!" Our 11 year old looks out from kitchen, with a mouthful of Cinnamon Toast Crunch, with little reaction and my wife muster's up a "Wow" and a manufactured (but seemingly sincere) courtesy smile - much like a mom forced to react to to an insignificant accomplishment by her small child, so as to make him feel proud. The gesture works on me as well.

Image from Investors Business Daily www.investors.com

posted by dan@hebbeln-ins.com